In 2023, DU is stepping up its game with an enticing range of DU devices that are bound to catch the eye of tech enthusiasts across the United Arab Emirates. If you’re looking to upgrade your smartphone or tablet, DU’s offerings are worth considering.

What’s even better? You can acquire these cutting-edge DU devices through mobile installment plans, even if you don’t have a credit card. In this article, we’ll guide you through the process of obtaining DU devices and mobile installment plans, addressing all your questions and concerns along the way.

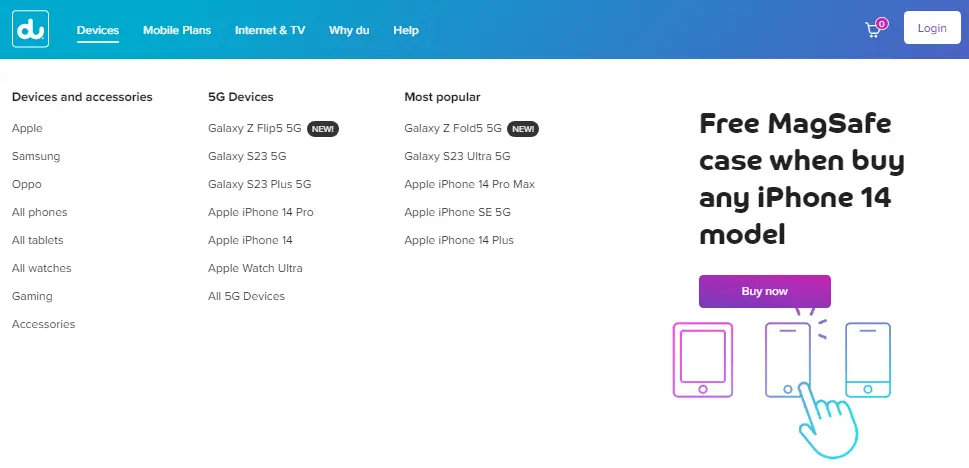

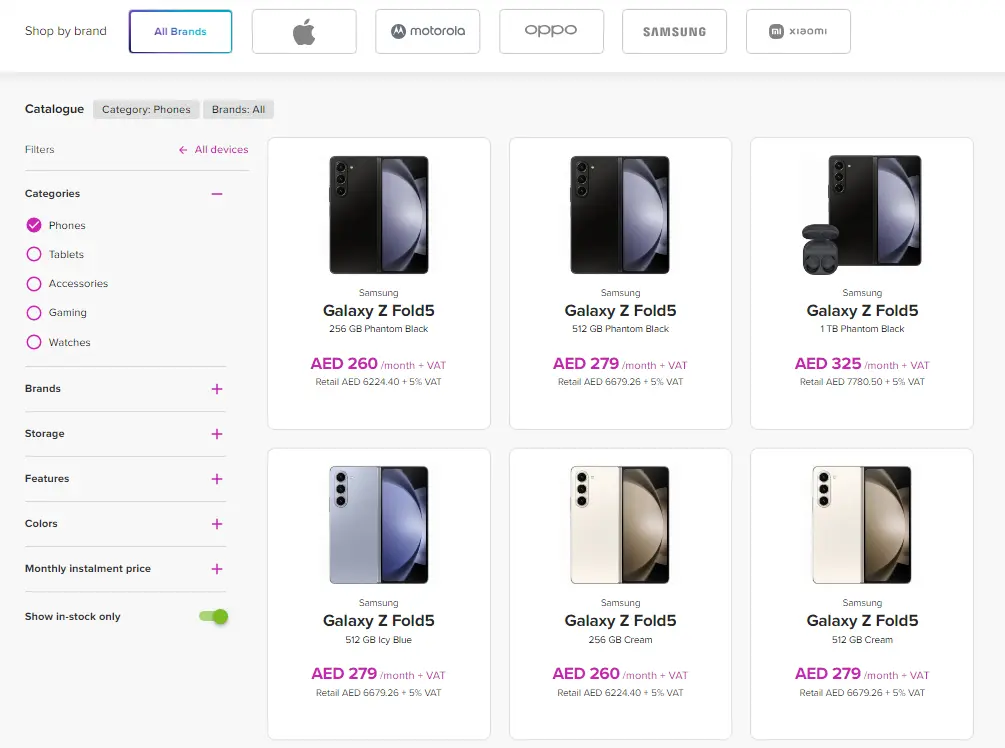

DU Devices 2023

DU has always been at the forefront of providing innovative and high-quality devices to its customers. The year 2023 is no different. With a wide array of smartphones, tablets, and gadgets to choose from, DU is ready to cater to various tastes and preferences. Whether you’re a photography enthusiast, a gaming aficionado, or simply seeking a reliable device for daily use, DU has you covered.

The Benefits of DU Mobile Installment Plans

DU’s mobile installment plans offer several advantages. They allow you to spread the cost of your new device over manageable monthly payments. Moreover, these plans often include additional perks such as data bundles, free minutes, and device insurance, making them an attractive option for budget-conscious consumers.

Read Also: DU Mobile Offers

Exploring the Range of DU Devices

Before diving into the world of DU devices, it’s crucial to explore the range available. Whether you’re interested in the latest iPhone, Android flagship, or a tablet for work and play, DU’s lineup is diverse. Take your time to review the specifications, features, and prices to find the device that suits your needs and budget.

DU shop UAE offers the latest mobile phones from Apple, Samsung, Huawei, Oppo, and more with or without an installment plan and with or without a DU postpaid plan. Customers can also find accessories for mobile phones, such as cases, chargers, and headphones. Of course, the list of devices sold by DU shop will be updated regularly because there will always be new release of mobile phones and other product.

Here’s how you can explore this range:

- Visit the DU Website: Start by visiting DU’s official website. There, you’ll find a dedicated section for devices, often categorized by type and brand. You can browse through the latest models, their specifications, and prices.

- Visit DU Stores: If you prefer a hands-on experience, consider visiting a physical DU store. Here, you can interact with the devices, compare them, and get expert advice from the staff.

- Read Reviews and Comparisons: To make an informed decision, read reviews and comparisons of the devices you’re interested in. This can help you understand their performance, features, and how they stack up against competitors.

- Consider Your Needs: Think about your specific needs. Are you a photography enthusiast, a gamer, or someone who requires a device for work? Consider the features and capabilities that matter most to you.

You can get the most recent DU mobile installment plan by clicking the link below:

Using DU Device with Existing Plan

If you’re already a DU customer with an existing plan, you’re in luck. DU offers the option to bundle your new device with your current plan. This seamless integration ensures that you enjoy the best of both worlds – a top-tier device and a plan that meets your connectivity needs. Here’s how you can do it:

- Review Your Current Plan: Begin by reviewing your existing DU plan. Take note of your data allowance, call minutes, and any additional services or benefits it offers.

- Device Compatibility: Ensure that the DU devices you wish to acquire is compatible with your existing plan. This typically involves checking the device’s network compatibility and any specific requirements mentioned by DU.

- Contact DU Customer Service: Reach out to DU’s customer support for assistance. They can guide you through the process of bundling your new device with your current plan. They’ll provide details on any adjustments needed to your plan and billing.

Read Also: DU Home Internet

DU Mobile Installment Plan Requirements

Eligibility Criteria

DU Mobile Installment Plans have certain eligibility criteria that applicants must meet to be considered for approval. These criteria are designed to ensure that individuals can responsibly manage the financial commitments of the plan. Here are the key eligibility criteria:

- Have a valid Emirates ID: You will typically need a valid Emirates ID, which is a government-issued identification card for residents of the United Arab Emirates. This serves as proof of your identity and residence in the country.

- Be at least 21 years old: You need to at least 21 years old to get this plan.

- Stable Income Source at least AED 3000: DU usually requires applicants to have a stable source of income. This income can come from various sources, such as employment, business, or investments. The purpose of this criterion is to assess your ability to make regular monthly payments. Moreover, you need to have a monthly salary of at least AED 3,000.

- Credit Assessment: DU may conduct a credit assessment as part of the eligibility process. While having a low credit score doesn’t necessarily disqualify you, a better credit history can lead to more favorable terms, such as lower interest rates or longer repayment periods.

Required Documentation

To streamline the application process and verify your eligibility, you will need to provide specific documentation when applying for a DU Mobile Installment Plan. Here’s a list of the required documents:

- Emirates ID: As mentioned earlier, your valid Emirates ID is a fundamental document to prove your identity and residency in the UAE.

- Proof of Income: To demonstrate your ability to meet the monthly payment obligations, you will typically need to provide proof of income. This can include:

- Salary Statements: Recent salary statements from your employer, showing your monthly income.

- Bank Statements: Bank statements that reflect your financial transactions and income deposits over a specified period.

- Employment Letter: A letter from your employer confirming your employment status, position, and salary.

- Additional Documents: Depending on the specific DU Mobile Installment Plan you’re applying for and your individual circumstances, DU may request additional documentation. These could include:

- Proof of Residence: Documents that confirm your current address in the UAE, such as utility bills or rental agreements.

- Trade License: If you’re a business owner, you may need to provide your company’s trade license and related documents.

It’s important to note that the exact requirements may vary based on the specific DU Mobile Installment Plan you’re interested in and DU’s policies at the time of application.

Therefore, it’s advisable to check with DU’s customer support or visit a DU store to get the most up-to-date and accurate information regarding the required documentation for your chosen plan.

Being prepared with the necessary documents will help expedite the application process and increase your chances of approval.

Read Also: DU Online Recharge

DU Mobile Installment Plan Without Credit Card

Alternative Payment Methods

Don’t fret if you don’t possess a credit card; DU offers alternative payment methods for your convenience. You can make payments using debit cards, bank transfers, or even opt for cash payments at DU’s physical stores or authorized payment centers.

Debit Cards

Debit cards are a convenient and widely accepted alternative to credit cards for making payments for DU Mobile Installment Plan. Here’s how it works:

- When applying for the installment plan, you can choose to make payments using your debit card.

- Ensure that your debit card has sufficient funds to cover the monthly installment amounts.

- DU will automatically deduct the installment amount from your debit card on the scheduled payment date each month.

- Debit card payments provide a secure and straightforward way to manage your installments without the need for a credit card.

Bank Transfers

Bank transfers offer another viable option for making payments towards your DU Mobile Installment Plan:

- When applying for the plan, you can select bank transfer as your preferred payment method.

- DU will provide you with the necessary bank account details for making payments.

- You will need to initiate the bank transfer from your own bank account, ensuring that you include the relevant reference or account number provided by DU.

- Bank transfers offer flexibility, allowing you to make payments from your bank account at your convenience.

Cash Payments

For those who prefer to make physical payments, DU often facilitates cash payments at its physical stores or authorized payment centers:

- Visit a DU store or an authorized payment center in your area.

- Inform the staff that you want to make a cash payment for your DU Mobile Installment Plan.

- Provide the necessary details, including your plan account number or customer information.

- Make the cash payment, and the staff will ensure that it is correctly applied to your installment plan.

How to Apply for DU Mobile Installment Plan Without a Credit Card

To apply for the DU Mobile Installment Plan without credit card, customers can follow these steps:

- Visit a DU Store or Website: You can apply for the installment plan by visiting a DU physical store or through the official DU website.

- Choose Your Desired DU Device: Select the DU device you wish to purchase through the installment plan. Ensure it is compatible with your selected plan.

- Complete the Application Form: Complete the application form by providing your personal and financial information, such as your Emirates ID, salary certificate, and bank statement

- Select Your Payment Method: Choose the payment plan that suits your budget. The payment plans range from 12 to 24 months, and the monthly installment amount depends on the device price and the payment plan duration.

- Submit Required Documentation: Provide the necessary documentation, including your Emirates ID and proof of income.

- Await DU’s Approval: DU will review your application and assess your eligibility. Approval typically takes a few business days.

- Receive Your Device: Once approved, you will receive your chosen DU device, and your selected payment method will be charged accordingly.

Read Also: DU Bill View

Conclusion

DU’s devices and mobile installment plans offer an enticing proposition for tech enthusiasts and budget-conscious consumers alike. With a wide range of devices and flexible payment options, DU makes it easier than ever to upgrade to the latest technology. Don’t hesitate to explore DU’s offerings and discover the perfect device for your needs!

FAQ

Here are some common questions and concerns about DU mobile installment plan:

- Can I apply for a DU mobile installment plan if I have a low credit score? DU assesses creditworthiness on a case-by-case basis, so having a low credit score doesn’t necessarily disqualify you. It’s best to reach out to DU directly for personalized assistance.

- Are DU mobile installment plan interest-free? DU’s installment plans may or may not include interest, depending on the specific plan and device. It’s advisable to review the terms and conditions to understand the financial aspects.

- Are there any hidden fees associated with DU’s installment plans? DU is transparent about its fees, and there are typically no hidden charges. Be sure to review the terms and conditions before signing up.

- Can I change my payment method during the installment period? DU may allow changes to your payment method, but it’s essential to contact their customer support or visit a DU store for assistance and to understand the process.

- How do I check my remaining balance on the installment plan? You can typically check your remaining balance and payment history through DU’s online portal or mobile app. DU’s customer support can also assist you with this information.

- Can I make extra payments to pay off the installment plan early? Yes, DU often allows early payment of the installment plan. However, be sure to check for any associated fees or terms regarding early repayment.

- Can I cancel my installment plan early? DU may allow early plan termination, but it could incur additional fees. It’s advisable to review the terms and conditions and contact DU for guidance.

- How much is the early cancellation fee for Du postpaid mobile service? The early cancellation fee for Du postpaid mobile service is typically AED 200 for each remaining month in the contract. Customers are usually required to provide a 30-day written notice by contacting Du customer care at customer.care@du.ae.

- Is there a grace period for missed payments? DU typically offers a grace period for missed payments, but it’s important to make payments as soon as possible to avoid late fees or service suspension.

- What happens if I miss an installment payment? Missing an installment payment may lead to late fees or temporary suspension of services. It’s essential to make payments on time or contact DU to discuss alternative arrangements if needed.

- Can I transfer my DU device installment plan to someone else? DU’s policies on transferring installment plans to another person may vary. It’s best to contact DU directly to inquire about transfer options and requirements.

- Is there a minimum and maximum contract duration for DU installment plans? DU’s installment plan durations can vary depending on the device and offer. Some may have a minimum contract duration, while others offer flexibility in choosing the installment period.

- What happens if I change my mobile number or address during the plan? Notify DU promptly if your contact details change to ensure that you receive important updates and communications regarding your plan.

- Can I upgrade my device during the installment period? Yes, DU often allows customers to upgrade their devices before completing the installment plan. Check with DU for details on their device upgrade policies.

- What happens if my DU devices is damaged or lost during the installment period? DU often provides device insurance as part of its installment plans. Check the terms and conditions to understand the coverage and procedures for addressing damage or loss.