How to Borrow Credit from Du – One of the most important things when you live in UAE is about smooth communication with your phone. As everybody knows, Du is one of the biggest a telecomunication providers in UAE and when you runs out of credit at a crucial moment can be frustrating, but Du has you covered with its credit borrowing service.

With Du’s credit borrowing service, you can borrow credit when you need it the most and pay it back later. In this article, we will discuss how to borrow credit from Du, the eligibility criteria, and the terms and conditions.

What is Borrowing Du Credit

Du credit borrow is a service provided by Du, a telecommunications company in the UAE, that allows its prepaid customers to borrow credit when they run out of balance and need to make urgent calls, send messages, or use data.

The borrowed credit is added to the customer’s account immediately, and the customer can use it for all prepaid services. However, the borrowed credit needs to be paid back within three days, and a service fee of 20% of the borrowed amount is deducted from the customer’s account at the time of repayment.

How to Borrow Credit from Du

It is important to know the way or the methods of borrowing credit from Du. To borrow credit from Du, follow these simple steps:

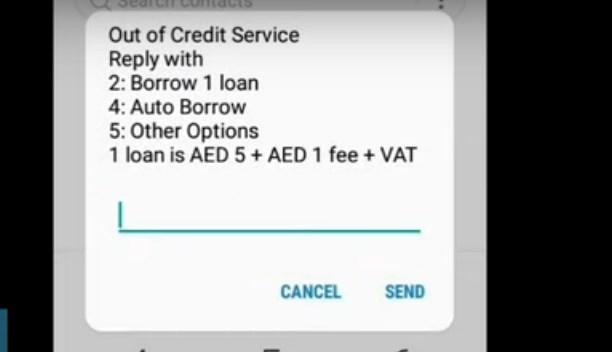

- Dial *108# from your Du mobile number.

- Then press number 2

- Choose the amount of credit you want to borrow.

- Confirm the transaction by following the instructions on the screen.

- The borrowed credit will be credited to your account immediately.

The other methods is by using SMS method, it is also simple method, you just need send SMS to 1080 by type number 5. Or you can call from your mobile phone by dialing 1 from your mobile phone and follow the instructions.

For instance, you can choose to borrow AED 5, AED 10, or AED 20 based on your requirement. Once you confirm the transaction, the borrowed credit will be added to your account immediately, and you can use it for all prepaid services.

Read Also : How to Transfer Du Balance

Just remember to pay back the borrowed credit within three days and keep track of your credit usage to avoid any suspension or penalty fees.

Eligibility Criteria

To be eligible for Du’s credit borrowing service, you must meet the following criteria:

- You must have an active Du prepaid mobile number.

- Your account must be at least three months old.

- You must have a good payment history.

- You must not have any outstanding debt on your account.

- You must have used at least AED 5 in the last 90 days.

Terms and Conditions

- The borrowed credit must be paid back within 3 days.

- A service fee of 20% of the borrowed credit amount will be deducted from your account.

- You can only borrow credit once your outstanding credit has been fully paid.

- The amount of credit that you can borrow depends on your usage and payment history.

- You cannot borrow credit if you have any outstanding debt on your account.

Final Words

In conclusion of the artilce how to borrow credit from Du is borrowing credit from Du is a convenient way to stay connected when you need it the most. By following the simple steps and meeting the eligibility criteria, you can easily borrow credit and pay it back within 3 days.

Just remember to keep track of your borrowing and make sure to pay it back on time to avoid any suspension or penalty fees.

FAQs

Q. Can I borrow credit if I have a postpaid Du account?

A. No, Du’s credit borrowing service is only available for prepaid accounts.

Q. What happens if I don’t pay back the borrowed credit within 3 days?

A. If you don’t pay back the borrowed credit within 3 days, your account will be suspended until the borrowed credit is fully paid.

Q. Can I borrow credit if I have an outstanding debt on my account?

A. No, you cannot borrow credit if you have any outstanding debt on your account.

Q. How much service fee will be charged for borrowing credit?

A. A service fee of 20% of the borrowed credit amount will be deducted from your account.

Q. How much credit can I borrow from Du?

A. The amount of credit that you can borrow depends on your usage and payment history.