Welcome, DU users! Are you looking to learn how to transfer balance from DU to DU number? You’ve come to the right place!

In this step-by-step guide, we will walk you through the process of transferring balance within DU. Whether you want to send credit to a friend or family member, or simply move funds between your own DU accounts, we’ve got you covered. Let’s dive in!

Understanding DU Balance Transfer

Before we jump into the nitty-gritty of the balance transfer process, let’s get familiar with the concept. Transferring balance from DU to DU simply means moving credit or funds from one DU number to another. It’s like handing over some of your credit to someone else, or shuffling credit between your own DU accounts.

There are different scenarios where balance transfer comes in handy. For instance, you might want to send credit to a loved one who is running low, or you might need to consolidate credit from multiple DU accounts into a single account for easier management. Whatever the reason, DU balance transfer offers a convenient way to handle these situations.

How to Transfer Balance from DU to DU

Now, let’s get down to business and learn how to transfer balance from DU to DU number. Follow these simple steps and you’ll be a balance transfer pro in no time!

Preparing for the Balance Transfer

- First things first, check the balance on the DU number from which you want to transfer credit. This will give you an idea of how much credit you have available for the transfer.

- Next, ensure that the receiver’s DU number has sufficient credit to receive the transfer. It’s like making sure there’s enough room in their “credit tank” to hold the transferred balance.

Initiating the Balance Transfer

- Access the DU balance transfer feature through your DU account. This can usually be done through the DU mobile app or the DU website. Look for the “Transfer Balance” option within your account.

- Once you’ve found the balance transfer option, select it and follow the on-screen instructions. You will be prompted to enter the receiver’s DU number, so make sure you have it handy.

- Enter the receiver’s DU number accurately. It’s like dialing the right phone number to make sure your call reaches the intended person.

- Double-check all the transfer details you entered, such as the receiver’s DU number and the transfer amount. Accuracy is key to a successful transfer.

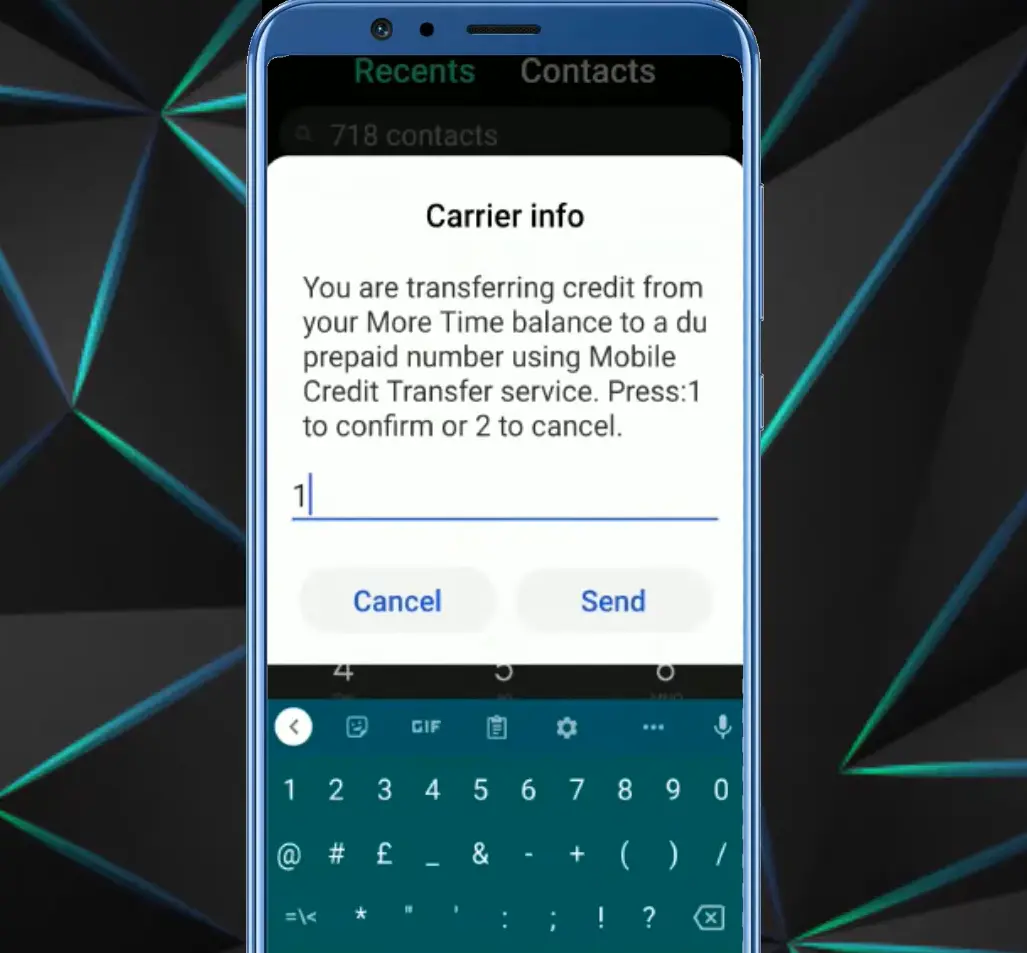

Confirming and Completing the Balance Transfer

- Review the transfer confirmation message that appears on your screen. It will summarize the details of your transfer, including the amount being transferred and the receiver’s DU number.

- Accept the transfer terms and conditions. These are usually standard terms that outline the responsibilities and rules associated with the transfer.

- Finally, click on the “Finalize” or “Confirm” button to complete the balance transfer process. Sit back, relax, and celebrate, because you’ve successfully transferred balance from one DU number to another!

Tips and Best Practices for a Successful DU Balance Transfer

Congratulations on completing your DU balance transfer! Now, let’s explore some tips and best practices to ensure a smooth and successful transfer experience.

Ensuring Accurate Recipient Information

When entering the receiver’s DU number, it’s crucial to double-check for any typos or errors. A single wrong digit can send the transfer to the wrong person or result in a failed transfer. So take a moment to carefully input the recipient’s DU number, just like you would enter the correct address when sending a DU package.

Verifying the Transfer Amount Before Confirming

Before finalizing the balance transfer, review the transfer amount to ensure it matches your intended amount. You wouldn’t want to accidentally transfer more or less credit than you intended. Pay attention to the details, just like you would double-check your shopping cart before making an online purchase.

Checking for Any Fees or Charges Associated with the Transfer

While most DU balance transfers are free of charge, it’s always a good idea to check if there are any fees or charges associated with the transfer. This information is usually available in the terms and conditions or the FAQs section of the DU website or app. Being aware of any fees will help you make informed decisions and avoid surprises, just like checking the fine print before making a purchase.

Troubleshooting Common Issues with DU Balance Transfer

Sometimes, despite our best efforts, issues may arise during a balance transfer. Here are a few common problems you might encounter and how to address them:

Transfer Failure or Error Messages

If you receive an error message or your transfer fails, don’t panic. Check your internet connection to ensure it’s stable and try again. If the problem persists, reach out to DU customer support for assistance. They are there to help and will guide you through the troubleshooting process.

Incorrect Transfer Amount or Recipient Number

In the event that you notice an incorrect transfer amount or recipient number after confirming the transfer, contact DU customer support immediately. They might be able to intervene and rectify the situation before the transfer is processed.

Contacting DU Customer Support for Assistance

If you encounter any issues or have questions throughout the balance transfer process, don’t hesitate to reach out to DU customer support. They have a dedicated team ready to assist you with any concerns or inquiries. Whether you prefer phone support, live chat, or email, they will provide the guidance you need.

Conclusion

Congratulations! You’ve completed our step-by-step guide on how to transfer balance from DU to DU. We hope this tutorial has empowered you to confidently navigate the DU balance transfer process. Remember, transferring balance within DU offers a convenient way to share credit with loved ones or consolidate credit for better management.

We encourage you to explore and utilize the DU balance transfer feature whenever the need arises. Whether you’re the credit superhero helping out a friend in need or simply streamlining your own credit management, DU has you covered. Enjoy the benefits and convenience of balance transfer within DU, and don’t forget to spread the word to fellow DU users. Happy transferring!