Monthly Installment Mobile Phone in UAE Without Credit Card – Hey there, tech-savvy shoppers! Are you looking to buy the latest smartphone without breaking the bank? You’re in luck! In this blog post, we’ll show you of monthly installment mobile phone in UAE without credit card, using pay later services.

In case if you’re looking for a way to check your id card status, you can check it at Emirates ID Status.

We’ve also compiled a list of the five best pay-later apps that you can use in the UAE. So, let’s dive right in!

As everybody knows, Buy now Pay later services are becoming increasingly popular, especially when it comes to purchasing gadgets like mobile phones.

These services let you buy now and pay later, splitting your payments into small, interest-free installments. The best part? You don’t need a credit card!

How Does it Works?

Using pay-later services is super simple. First, find a retailer that accepts one of the pay-later apps mentioned below. Then, select the mobile phone you want and choose the pay-later option during checkout.

You’ll need to create an account with the pay-later service, and they’ll verify your identity and financial ability to make the payments. Once approved, you can split the cost of the phone into manageable installments.

Monthly Installment Mobile Phone in UAE Without Credit Card

In the UAE, there are various options for purchasing a mobile phone on a monthly installment plan without a credit card. Many retailers, such as Sharaf DG, Emax, Jumbo, and Carrefour, offer in-store financing options where you can buy a mobile phone on monthly installments without using a credit card.

You will typically need to provide your Emirates ID, a copy of your passport, salary certificate or bank statement, and possibly a post-dated cheque.

The another way is by using Etisalat or Du, the major telecom providers in the UAE. They offer postpaid plans with mobile phones bundled into the contract.

You can purchase a mobile phone on a monthly installment basis along with your postpaid mobile service without the need for a credit card.

But recently, there are so many apps with their motto Buy Now Pay Later attract many people in UAE, because of its simple and easy to use, the apps become so popular especially for young people. Now, let’s take a look at the five best pay-later apps in the UAE:

Tabby

Tabby is a popular choice in the UAE. It lets you buy a mobile phone and pay in interest-free installments or pay the full amount within 14 days. They’ve partnered with numerous retailers, making it super easy to find the perfect phone for you!

– Interest-free payment

Tabby allows customers to pay for their purchases in interest-free installments, making it easier to manage their expenses.

– Flexible payment options

Tabby offers two primary payment options:

a. Pay in Installments: Users can split their purchases into equal, interest-free installments over a specified period, typically 14 or 30 days.

b. Pay Later: Customers can pay the full amount within a specified period, usually 14 days after the purchase, without incurring any interest.

– Wide range of partner retailers

Tabby has partnered with numerous retailers in various sectors, including electronics, fashion, and home goods. This makes it easy for users to find and purchase the products they want using Tabby’s services.

– Simple and quick approval process

Tabby’s registration and approval process is straightforward and fast. Customers provide basic information, such as their name, mobile number, email address, and Emirates ID. Tabby then conducts a quick assessment of the customer’s financial capability before approving the transaction.

– No hidden fees

Tabby is transparent about its fees, and users typically do not incur any hidden charges or additional costs when using the service.

Spotii

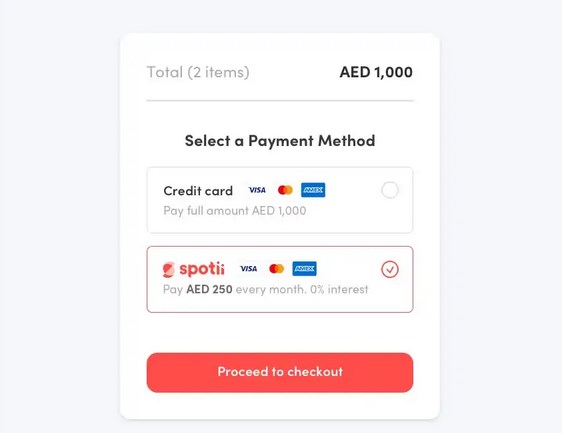

Spotii is another go-to pay-later service in the UAE. They offer a flexible, interest-free installment plan that helps make your dream phone more affordable. Just choose Spotii at checkout, and you’re good to go!

Spotii allows customers to make purchases without incurring any interest charges. The payments are typically split into equal, interest-free installments.

Postpay

Postpay enables you to purchase your mobile phone in interest-free monthly installments. With a simple sign-up process and various retailers to choose from, it’s a hassle-free way to shop.

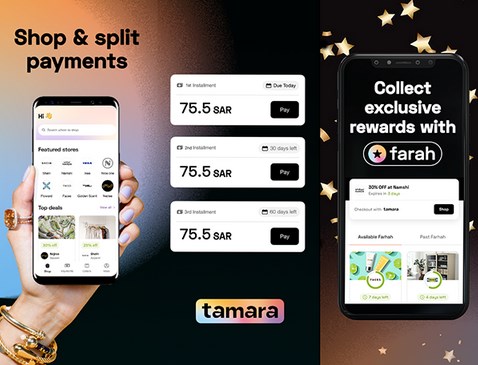

Tamara

Tamara is another great choice for buying mobile phones on monthly installments. With Tamara, you can enjoy a seamless shopping experience with no interest, no fees, and easy approval.

Cashew

Cashew allows you to make purchases in interest-free installments. With their easy-to-use app and various partnerships with retailers, buying a mobile phone on monthly installments has never been more accessible.

Remember to always read the terms and conditions before using any pay-later service, and make sure you can comfortably afford the installments.

So, there you have it! With these five fantastic pay-later apps, getting your hands on the latest mobile phone in the UAE without a credit card is a piece of cake. What are you waiting for? Grab your dream phone today and start showing off your shiny new tech!

The Eligibility

The eligibility criteria for registering with pay-later apps in the UAE can vary depending on the specific platform you choose. However, there are some common requirements that most pay-later services in the UAE share. Here’s a general overview of the eligibility criteria:

- You must be at least 18 years old to use pay-later services.

- You must be a resident of the UAE and you need to provide your Emirates ID during the registration process.

- Valid mobile number and email address

- Having Bank account or debit card

- Creditworthiness

- No history of defaults or late payments

Please note that the specific eligibility criteria for each pay-later app may differ, so it’s crucial to check the requirements on the app’s website or during the registration process.

Keep in mind that registering with a pay-later app does not guarantee approval for every purchase, as the platform may still assess your creditworthiness and financial situation for each transaction.

Final Words

In conclusion, pay-later apps in the UAE offer a convenient way to purchase mobile phones on monthly installments without the need for a credit card. These apps provide flexible, interest-free payment options that cater to a wide range of customers.

However, to be eligible to use these services, you must typically meet certain criteria, such as being 18 years or older, a resident of the UAE, and having a valid mobile number, email address, and bank account or debit card.

Keep in mind that the specific eligibility criteria can vary depending on the pay-later app, and registering doesn’t guarantee approval for every purchase.

Always check the requirements for each app, read the terms and conditions, and ensure that you can afford the installments before committing to any pay-later agreement.

With careful consideration and research, you can find the right pay-later service that fits your needs and enables you to purchase your dream mobile phone in a financially responsible way.