In today’s digital era, mobile banking has become an integral part of our lives. It offers unparalleled convenience and flexibility, allowing us to manage our finances on the go. ADCB Hayyak is a revolutionary mobile banking solution that brings a host of features and benefits right to your fingertips.

In this article, we will explore the significance of ADCB Hayyak in mobile banking and delve into its various functionalities that make it a preferred choice for individuals seeking instant account opening, seamless transactions, enhanced financial tools, and more.

What is ADCB Hayyak?

ADCB Hayyak is a digital banking service provided by Abu Dhabi Commercial Bank (ADCB) in the United Arab Emirates (UAE). It offers a convenient way for UAE residents who are 21 years or older to open an account with ADCB, without the need to visit a branch physically.

Account Options and Solutions

ADCB Hayyak Account Options and Solutions cater to both current account and savings account needs, offering flexibility and tailored solutions for customers.

A. Current Account or Savings Account

ADCB Hayyak Account provides options for both current accounts and savings accounts. A current account is typically used for day-to-day banking transactions, such as receiving and making payments, while a savings account is designed for individuals to save and earn interest on their deposits.

The ADCB Hayyak Account allows customers to choose between a current account or a savings account based on their specific requirements. The current account is suitable for those who frequently engage in financial transactions and require easy access to their funds.

On the other hand, the savings account provides individuals with the opportunity to accumulate savings and earn interest on their balances over time.

B. Regular or Shari’ah Compliant Solutions

ADCB Hayyak Account offers both regular and Shari’ah compliant solutions to cater to the diverse preferences and requirements of customers. Regular solutions follow conventional banking practices, while Shari’ah compliant solutions adhere to Islamic principles.

For customers seeking Shari’ah compliant banking solutions, ADCB Hayyak Account provides options that comply with Islamic finance principles. These solutions are designed to ensure that the banking practices align with ethical and religious guidelines.

By offering both regular and Shari’ah compliant solutions, ADCB Hayyak Account aims to accommodate customers from various backgrounds and preferences, allowing them to choose the account type that best suits their banking needs while ensuring their financial requirements are met in a manner aligned with their values.

Benefits of ADCB Hayyak Account Opening

The ADCB Hayyak account opening provides several benefits that cater to customers’ convenience and flexibility. Here are the specific benefits of opening an ADCB Hayyak account:

- Hassle-Free Account Opening: ADCB Hayyak offers a seamless and hassle-free process for opening an ADCB account through a mobile app. This digital platform eliminates the need for visiting a branch or completing extensive paperwork, allowing users to open an account quickly and securely.

- ADCB Hayyak zero balance account charges for free: It is one of the best benefit compared to other bank. There are no charge if your balance is zero.

- Flexibility in Account Types: ADCB Hayyak provides flexibility in choosing between current and savings accounts, allowing customers to select the account type that suits their financial needs. Additionally, the platform also offers Shari’ah-compliant solutions for those seeking Islamic banking options.

- Personal Loans and Credit Cards: ADCB Hayyak enables users to apply for personal loans and credit cards directly through the app. The loan application process is streamlined, and eligible customers can receive instant credit into their newly opened ADCB account, based on salary and end-of-service benefits. The app also offers the option to apply for a credit card with instant approval.

ADCB Hayyak Credit Cards - Welcome Kit Delivery: Upon successful account opening, ADCB Hayyak ensures the delivery of a welcome kit within a timeframe of 24 to 48 hours. The welcome kit includes important account information, such as debit cards, credit cards, and cheque leaves, allowing customers to access and utilize their account services promptly.

- ADCB TouchPoints Rewards Program: Users of ADCB Hayyak are automatically enrolled in the ADCB TouchPoints Rewards Program]. This program offers the opportunity to earn TouchPoints for various transactions and activities carried out using the ADCB Hayyak account. TouchPoints can be accumulated and later redeemed for a range of benefits, including flights, shopping, utility bill payments, and conversions to airline loyalty program miles.

By combining the convenience of digital account opening, flexibility in account types, access to personal loans and credit cards, prompt delivery of welcome kits, and participation in the TouchPoints Rewards Program, ADCB Hayyak aims to provide customers with a comprehensive and rewarding banking experience.

Instant Account Opening with ADCB Hayyak

Gone are the days of lengthy paperwork and waiting in queues to open a bank account. With ADCB Hayyak, you can open an account instantly and experience the utmost convenience.

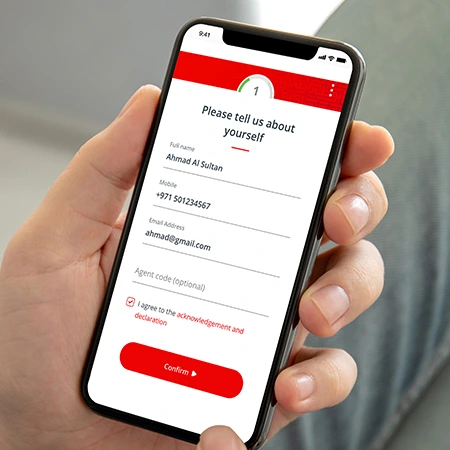

Whether you’re a new customer or an existing ADCB customer, the process is swift and hassle-free. The Hayyak app allows you to complete the account opening process anytime, anywhere, using your smartphone or tablet.

The ADCB Hayyak app is designed with user-friendliness in mind. Upon registration, you can seamlessly log in to your account and access a world of banking services at your fingertips.

The intuitive interface ensures a smooth navigation experience, making it easy for users to explore and utilize the app’s features. From viewing account balances to managing transactions, ADCB Hayyak provides a comprehensive suite of services tailored to meet your banking needs.

To open an ADCB Hayyak Zero Balance Account, you can follow the steps outlined below:

- Ensure eligibility: To open an ADCB Hayyak Zero Balance Account, you need to be at least 21 years old and reside in the UAE.

- Access ADCB Personal Internet Banking: Visit the ADCB website and access the Personal Internet Banking portal.

- Initiate the account opening process: Navigate to the account opening section within ADCB Personal Internet Banking and select the option to open an ADCB Hayyak Zero Balance Account.

- Provide personal details: Fill in the required personal information, such as your name, contact details, and address. Ensure that all the information provided is accurate and up to date.

- Complete the application: Follow the instructions provided on the screen and complete the application form for opening a Zero Balance Account. Make sure to review the terms and conditions associated with the account.

- Verify identification documents: As part of the account opening process, you may need to scan and upload identification documents such as your passport and Emirates ID. Ensure that the scanned documents are clear and legible.

- Submit the application: After providing all the necessary information and verifying your identification documents, submit the application for processing.

- Wait for approval: ADCB will review your application and may require additional verification if necessary. Once the application is approved, you will receive confirmation of the account opening.

- Collect account details: You will receive the account details, including the account number and other relevant information. These details will be required for future transactions and account management.

- Access and manage your account: Once your ADCB Hayyak Zero Balance Account is opened, you can access and manage it through ADCB Personal Internet Banking. This allows you to perform various banking activities, such as making deposits, transferring funds, and checking your account balance.

If you’re still confuse after following the steps above, you may try to watch the official video below:

Welcome Kit and Rewards

A. Delivery of Welcome Kit within 48 hours

ADCB Hayyak offers a hassle-free account opening process through a mobile app. After successfully opening an account, customers can expect to receive a welcome kit, which includes a cheque book and cards, within 48 hours.

This quick delivery ensures that customers can start using their ADCB Hayyak account and its associated features without delay. The welcome kit is an essential package that provides customers with the necessary tools to carry out banking transactions conveniently.

B. ADCB TouchPoints Rewards Program

ADCB Hayyak users are automatically enrolled in the ADCB TouchPoints Rewards Program. This program allows customers to earn rewards for various transactions and activities carried out using their ADCB Hayyak account.

The ADCB TouchPoints can be accumulated and later redeemed for a range of benefits, including free flights and shopping.

By participating in the ADCB TouchPoints Rewards Program, customers can maximize the value they receive from their banking activities and enjoy additional perks and privileges.

The combination of the quick delivery of the welcome kit and the inclusion in the ADCB TouchPoints Rewards Program demonstrates ADCB’s commitment to providing a seamless and rewarding banking experience for ADCB Hayyak customers.

These features aim to enhance customer satisfaction by ensuring timely access to account essentials and offering attractive rewards for their banking activities.

Seamless Transactions and Account Management

ADCB Hayyak empowers you with seamless transaction capabilities, enabling you to manage your finances effortlessly. Whether you need to transfer money to a friend or family member or make bill payments, the Hayyak app simplifies the process. With just a few taps, you can initiate transfers and payments securely and conveniently.

Keeping track of your account balance is crucial for effective financial management. ADCB Hayyak ensures that you stay updated with your account’s financial health at all times.

The app allows you to check your balance instantly, eliminating the need to visit a physical branch or ATM. This feature provides you with real-time information, allowing you to make informed financial decisions.

Enhanced Financial Tools and Services

ADCB Hayyak goes beyond basic banking functionalities by offering a range of financial tools and services to enhance your banking experience.

Managing personal finances becomes a breeze with the Hayyak app’s intelligent features. You can set financial goals, track your expenses, and monitor your saving progress with ease.

For those looking to grow their wealth, ADCB Hayyak offers investment options tailored to suit various risk appetites. From conservative to aggressive investments, the app provides a platform to explore and invest in a diverse range of investment opportunities.

ADCB Hayyak also offers a comprehensive suite of credit card and loan options to cater to your financial needs.

Whether you’re planning a dream vacation or need funding for a major purchase, the app provides easy access to credit facilities, ensuring that your financial requirements are met seamlessly.

Customer Support and Security

Exceptional customer support is at the core of ADCB Hayyak’s service philosophy. The app provides multiple channels to address your queries and concerns.

Whether you prefer to chat with a customer service representative or seek assistance through the app’s comprehensive FAQ section, ADCB Hayyak ensures that your banking experience is supported by prompt and reliable customer service.

Security is of utmost importance in the realm of mobile banking, and ADCB Hayyak prioritizes the safety of your financial information. The app incorporates robust security measures and protocols to safeguard your data from unauthorized access.

From secure login procedures to encrypted transactions, ADCB Hayyak provides you with peace of mind while conducting your banking activities.

Locating ADCB ATMs and Branches

ADCB Hayyak simplifies the process of locating ADCB ATMs and branches, offering utmost convenience to its users. The app’s ATM and branch locator feature enables you to find the nearest ADCB service points with just a few taps on your device.

Whether you need to withdraw cash or visit a branch for any banking-related assistance, ADCB Hayyak ensures that you can easily locate the nearest service point without any hassle.

Last Words

ADCB Hayyak revolutionizes the way we bank by providing instant account opening, flexibility, and convenience through its feature-rich mobile banking app.

With its seamless transaction capabilities, enhanced financial tools, and top-notch customer support, ADCB Hayyak offers a comprehensive banking experience that caters to the needs of modern-day individuals.

Download the ADCB Hayyak app today and unlock a world of banking convenience at your fingertips.

FAQs

How secure is ADCB Hayyak?

ADCB Hayyak prioritizes the security of your financial information. The app incorporates robust security measures and protocols to safeguard your data from unauthorized access. From secure login procedures to encrypted transactions, ADCB Hayyak ensures the utmost security while conducting your banking activities.

Can I open multiple ADCB Hayyak accounts?

Yes, ADCB Hayyak allows customers to open up to five accounts.

Is ADCB Hayyak available for both new and existing ADCB customers?

Yes, ADCB Hayyak is available for both new and existing ADCB customers. The app provides a seamless account opening process for new customers and enables existing customers to access their accounts instantly.

What kind of financial tools does ADCB Hayyak offer?

ADCB Hayyak offers a range of financial tools to enhance your banking experience. You can set financial goals, track your expenses, and monitor your saving progress using the app’s intelligent features. Additionally, the app provides investment, credit card, and loan options to cater to your diverse financial needs.

Can I locate ADCB ATMs and branches using ADCB Hayyak?

Yes, ADCB Hayyak simplifies the process of locating ADCB ATMs and branches. The app’s ATM and branch locator feature enables you to find the nearest service points with ease, ensuring utmost convenience for your banking needs.

Are there any charges or fees associated with ADCB Hayyak?

While there is no minimum balance requirement, other fees and charges may apply for specific transactions or services.

Can I earn rewards with ADCB Hayyak?

Yes, ADCB Hayyak users are automatically enrolled in the TouchPoints Rewards Program, which allows them to earn rewards for various banking activities.

Is the ADCB Hayyak account available to non-UAE residents?

ADCB Hayyak is specifically designed for UAE residents aged 21 and above, so it may not be available for non-UAE residents.

Can I pick up debit cards, credit cards, and cheque leaves for my ADCB Hayyak account?

Yes, you can pick up debit cards, credit cards, and cheque leaves from uBank centers in the UAE.