ADCB Hayyak Zero Balance Account Charges – ADCB Hayyak provides a hassle-free way to open an account with Abu Dhabi Commercial Bank (ADCB), offering flexibility and convenience through a mobile app. Whether you prefer a current account or a savings account, ADCB Hayyak caters to your banking needs.

But the most catchy feature is “ADCB Hayyak Zero Balance Account Charges“. So what is ADCB Hayyak zero balance account benefits? How much ADCB Hayyak zero balance account charges? Let’s find out the answer in this article!

ADCB Hayyak Zero Balance Account Charges

ADCB Hayyak is a banking service offered by ADCB (Abu Dhabi Commercial Bank) that is designed to provide a hassle-free way of opening an ADCB account with certain benefits. One specific feature of ADCB Hayyak is that it does not have a minimum balance requirement.

Typically, many bank accounts require customers to maintain a minimum balance in their accounts to avoid certain charges or fees. This minimum balance requirement ensures that the account remains active and covers any operational costs associated with maintaining the account.

However, with ADCB Hayyak, customers can open a Current or Savings account without the obligation of maintaining a minimum balance. This means that even if the account balance drops to zero, there won’t be any penalties or charges for not meeting the minimum balance requirement.

The “No Minimum Balance Requirement” feature of ADCB Hayyak provides customers with flexibility and convenience. It allows individuals to open and use an ADCB account without worrying about maintaining a specific amount in their account at all times.

This feature can be particularly beneficial for customers who may have varying financial situations or prefer not to maintain a minimum balance in their accounts.

It’s important to note that while ADCB Hayyak does not have a minimum balance requirement, other fees and charges may still apply for specific transactions or services.

For a comprehensive understanding of the terms and conditions, as well as any applicable fees associated with ADCB Hayyak, it is recommended to refer to ADCB’s official website or contact their customer support directly.

What is ADCB Hayyak zero balance account benefits?

There are also other benefit beside ADCB Hayyak zero balance account charges free. Here is a detailed explanation of the benefits:

No Minimum Balance Requirement

As we explained above, one of the key benefits of the ADCB Hayyak Zero Balance Account is that it does not require customers to maintain a minimum balance in their account.

This feature makes it convenient for individuals who may not have a significant amount of funds to keep in their account or prefer not to maintain a minimum balance.

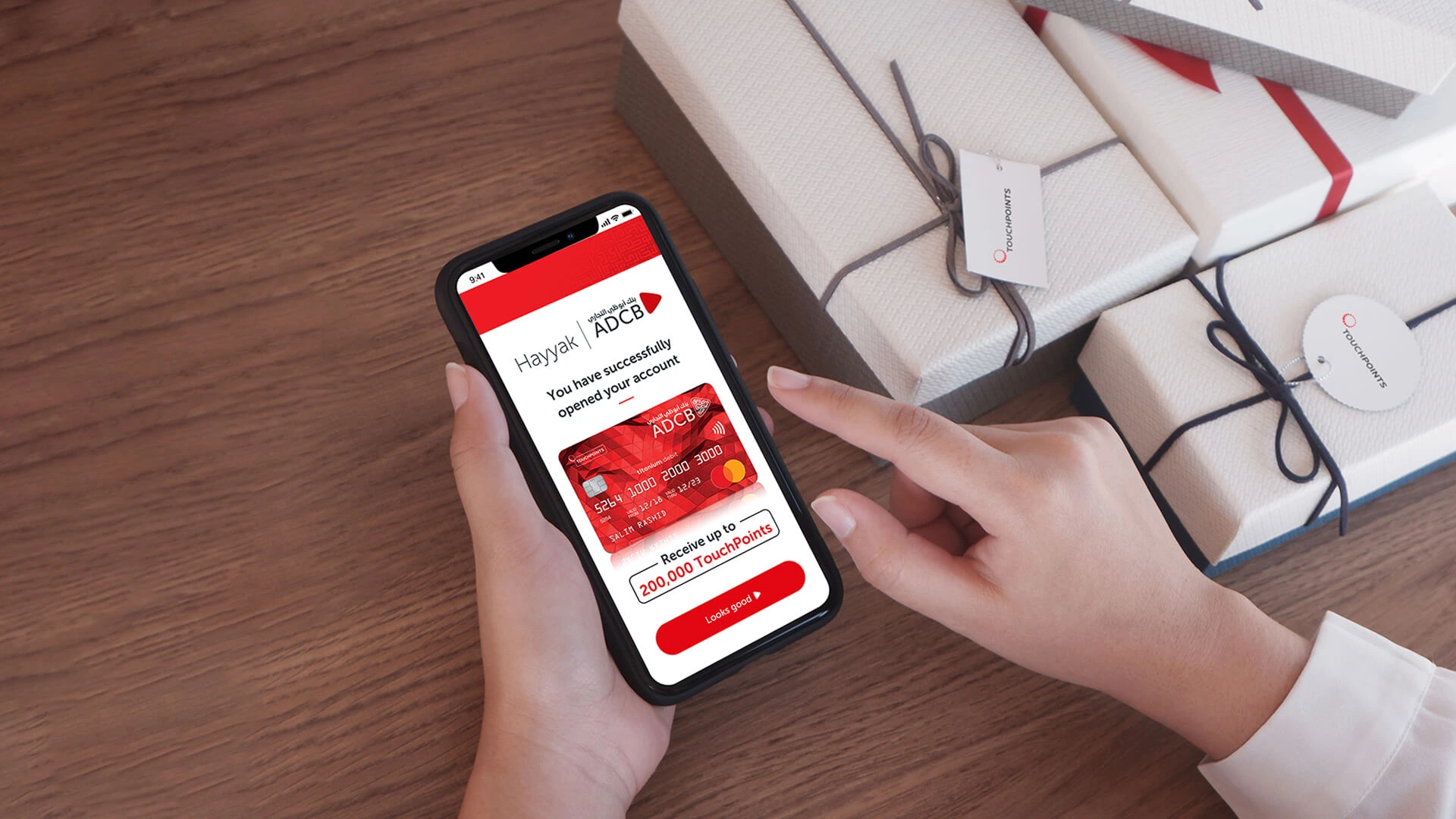

Easy Account Opening

Opening an ADCB Hayyak Zero Balance Account is a hassle-free and streamlined process. Users can open the account quickly through the ADCB Hayyak mobile app or website without the need to visit a branch or complete extensive paperwork.

The account opening process involves scanning identification documents, providing basic details, and uploading a signature.

Flexible Account Types

The ADCB Hayyak Zero Balance Account offers flexibility in choosing the type of account that suits individual banking needs. Users can opt for either a current account or a savings account based on their requirements.

The account can also be Sharia-compliant, providing Islamic banking options for those seeking financial solutions that align with their beliefs.

ADCB TouchPoints Rewards Program

Opening an ADCB Hayyak Zero Balance Account automatically enrolls users in the ADCB TouchPoints Rewards Program.

This program allows customers to earn TouchPoints for various banking activities, including deposits, transactions, and using ADCB products and services. TouchPoints can be redeemed for a wide range of rewards, such as travel, shopping vouchers, utility bill payments, and more.

Convenient Banking Services

ADCB Hayyak Zero Balance Account provides customers with access to a range of convenient banking services.

These include online and mobile banking facilities, allowing users to manage their accounts, make transfers, pay bills, and perform other banking transactions conveniently from their devices.

The account also offers access to a network of uBank centers where customers can collect their debit cards, credit cards, and cheque books.

Personal Loan and Credit Card Options

ADCB Hayyak Zero Balance Account users have the opportunity to apply for personal loans and credit cards through the account.

The account opening process includes a feature that allows users to calculate loan options, and if eligible, receive instant credit into their newly opened ADCB account.

The loans are granted based on salary assignment and end-of-service benefits, providing users with additional financial flexibility.

Last Words

Opening an ADCB Hayyak account brings you numerous benefits and unparalleled convenience. The account opening process through the user-friendly app saves you time and effort.

Don’t miss out on the opportunity to experience seamless banking with ADCB Hayyak. Open an account today and enjoy the convenience and benefits it offers. Take the first step toward financial empowerment with ADCB Hayyak!

FAQs

What are the account options available with ADCB Hayyak?

ADCB Hayyak offers two primary account options: the Current account and the Savings account. The Current account is suitable for those who need regular banking services, while the Savings account provides attractive interest rates for individuals looking to grow their savings.

Are there any monthly maintenance requirements or transaction fees associated with ADCB Hayyak Zero Balance Account?

No, there are no monthly maintenance requirements or transaction fees for ADCB Hayyak Zero Balance Account.

Can I earn rewards with the ADCB Hayyak Zero Balance Account?

Yes, ADCB Hayyak customers are automatically enrolled in the ADCB TouchPoints Rewards Program. You can earn rewards for various banking activities, enhancing your banking experience.

Are Islamic finance options available with the ADCB Hayyak Zero Balance Account?

Yes, ADCB Hayyak offers Islamic finance options for customers seeking Shari’ah-compliant financial solutions. This ensures that customers can align their banking preferences with their beliefs.

Where can I pick up my debit cards, credit cards, and cheque leaves for the ADCB Hayyak Zero Balance Account?

Customers can conveniently pick up their debit cards, credit cards, and cheque leaves from uBank centers located across the UAE. These centers provide accessibility for customers to manage their financial transactions efficiently.