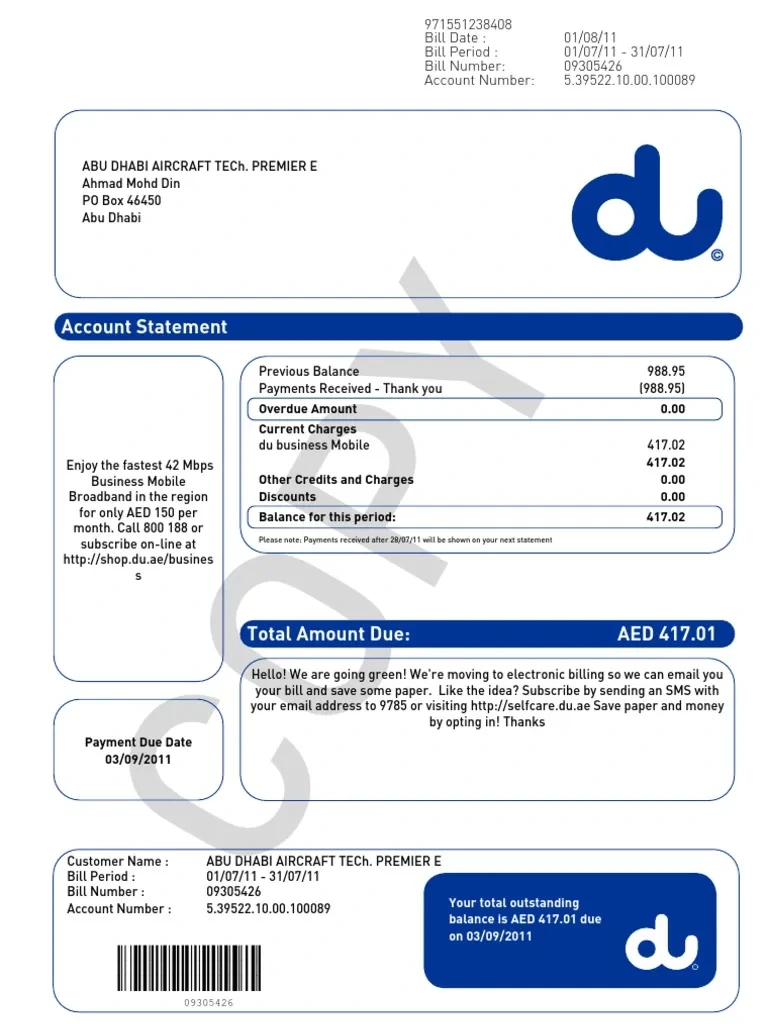

In the rapidly advancing digital age, where technology has become an integral part of our daily lives, even the seemingly mundane tasks of bill payments have been transformed into seamless experiences. DU Bill Payment is one exceptional service that has risen to prominence in telecommunications.

What is DU Payment?

DU Payment encapsulates a revolutionary approach to bill settlement. It offers a comprehensive and contemporary solution that transcends conventional payment methods.

This pioneering platform has garnered acclaim for its seamless user experience, fortified security protocols, and various versatile payment avenues. While basking in widespread appreciation, DU Payment remains committed to fine-tuning its processes, addressing sporadic concerns, and further refining its services to redefine the landscape of modern bill payments.

DU Bill Payment Process

Navigating through the intricacies of DU Bill Payment is a straightforward endeavour, ensuring a hassle-free experience for users.

Step by Step Guide

1. Access the Platform

Begin by logging into your DU Bill Payment account. If you’re a new user, you must sign up, providing the necessary details to create your account.

2. Select the Service

Once logged in, choose the service you intend to pay for. This could include your mobile bill, home phone charges, or broadband subscription.

3. Enter Payment Details

Provide the required payment information, such as the bill amount and other pertinent details. Double-check the accuracy of the data to ensure a smooth transaction.

4. Choose Payment Method

DU Bill Payment offers a range of payment methods to suit your preferences. You can opt for credit/debit card payments, online banking transfers, or other supported methods.

5. Review and Confirm

Before finalizing the payment, take a moment to review the details you’ve entered. Verify the amount, service, and payment method to avoid any errors.

6. Secure Transaction

DU Bill Payment prioritizes the security of your data. The platform employs cutting-edge encryption and secure socket layer (SSL) technology to safeguard your sensitive information during the transaction.

7. Transaction Confirmation

After completing the payment, you will receive a confirmation message on the platform indicating a successful transaction. This confirmation serves as a receipt for your records.

Payment History

DU Bill Payment also provides a comprehensive payment history, allowing you to track and monitor past transactions. This feature ensures you have a clear overview of your financial activity.

Account Management

Beyond payments, DU Bill Payment allows you to manage various aspects of your account. You can update your payment methods, set up auto payments for convenience, and manage your preferences.

Support and Assistance

If you encounter any difficulties or have questions, DU Bill Payment offers customer support services to assist you. You can reach out for guidance or resolutions to any issues you face.

Features of DU Payment

Versatility

DU Payment offers comprehensive payment options catering to diverse customer needs. Whether you’re looking to pay your mobile bill, settle your home phone charges, or manage your broadband subscription, DU Payment has covered you.

This versatile platform acts as a one-stop solution, streamlining the payment process for multiple services and ensuring the utmost convenience for all users. Here’s how its features contribute to this versatility:

- Multiple Service Payments: DU Payment allows users to pay for various services, including mobile, home phone, and broadband bills. This means you can conveniently settle accounts from different categories, all within the same platform.

- Unified Payment Platform: DU Payment simplifies managing different bills by offering multiple payment options under one roof. Users can access and handle various types of payments through a single platform, eliminating the need to navigate between multiple interfaces.

- Flexibility in Payment Methods: DU Payment offers users a variety of payment methods. Whether you prefer using credit/debit cards, bank transfers, or digital wallets, the platform accommodates your preferred method, adding to its adaptability.

- Customized Payment Plans: Depending on the type of service you’re paying for, DU Payment provides flexibility in choosing payment plans. This can be particularly useful for aligning your payments with your financial preferences or due dates.

- Bill Consolidation: DU Payment’s versatile nature extends to consolidating bills. Instead of managing separate payments for different services, you can reduce them into a single transaction, enhancing convenience and clarity.

- Ease of Switching Services: The platform’s versatility also includes switching or modifying services seamlessly. You can change your subscription plans, add or remove services, and adjust billing preferences without navigating convoluted processes.

- Cross-Device Accessibility: DU Payment ensures that its versatility is accessible across various devices, be it smartphones, tablets, or desktops. This adaptability enables users to make payments at their convenience, regardless of their device.

User-friendly Interface

Its user-friendly interface makes navigating through DU Payment’s services a breeze. Designed with simplicity, the platform presents a clean and intuitive layout that guides users effortlessly through the payment journey.

With just a few clicks, you can select your desired service, enter payment details, and finalize transactions, making the entire process smooth and hassle-free.

- Intuitive Navigation. The interface of DU Payment boasts an intuitive layout that guides users effortlessly through various options and actions. Whether you’re a first-time user or a frequent visitor, the platform’s design simplifies navigation, allowing users to find their desired services and complete transactions without confusion.

- Simplicity in Design. The design philosophy of DU Payment revolves around simplicity. The interface employs a clean and uncluttered layout, reducing visual noise and ensuring users can quickly locate the necessary functions. This design ethos enhances user engagement and minimizes the learning curve associated with using the platform.

- Seamless Transaction Flow. DU Payment’s interface is carefully crafted to facilitate smooth transaction flows. From selecting the desired service to entering payment details and confirming the transaction, every step is orchestrated to minimize complexity and optimize user interaction. This ensures that users can complete their payments swiftly and effortlessly.

- Clear Call-to-Action Elements. The interface incorporates clear and prominent call-to-action elements, such as buttons and links, that guide users to the next logical step. These elements are strategically placed to provide a visual hierarchy, making it evident where users need to click or tap to initiate actions, enhancing usability.

- Responsive Design. DU Payment’s user-friendly interface is responsive across devices, including desktops, laptops, tablets, and smartphones. This adaptability ensures that users can access the platform from various devices without sacrificing the quality of their experience. The interface seamlessly adjusts to different screen sizes, maintaining usability and functionality.

- User-Centric Features. Beyond the visual aspects, DU Payment’s interface is designed with the user in mind. Features such as autofill for commonly entered information, error prevention mechanisms, and real-time feedback during input contribute to a smooth and frustration-free interaction.

- Personalization. DU Payment’s interface might also offer some personalization, allowing users to save payment methods, view transaction histories, and set preferences according to their needs. This level of customization enhances the overall experience and further simplifies future interactions.

Secure Transactions

DU Payment goes above and beyond regarding safeguarding user data and secure transactions. The platform strongly emphasizes data security, implementing robust measures to protect sensitive information.

By utilizing cutting-edge encryption techniques, secure socket layer (SSL) technology, and tokenization, DU Payment guarantees that your personal and financial data remain confidential and well-guarded throughout every transaction. Rest assured; your safety is a top priority for DU Payment.

Additionally, DU Payment partners with globally recognized cybersecurity experts to regularly audit and enhance its security protocols. This proactive approach ensures that the platform remains at the forefront of data protection, giving users peace of mind while conducting payment activities.

As you explore the versatile features of DU Payment, you’ll appreciate the convenience, user-friendly design, and unwavering commitment to maintaining the highest level of security. Experience the future of hassle-free, secure transactions with DU Payment today.

Benefits of DU Bill Payment

At the core of DU Bill Payment lie many benefits that transcend traditional bill payment methods, making it a compelling choice for modern consumers.

Convenience

Experience the ultimate convenience with DU Bill Payment, allowing you to finalize transactions from the comfort of your home or office. Say goodbye to the inconvenience of commuting to physical locations or enduring long queues just to settle your bills. With 24/7 accessibility, DU Bill Payment lets you control your payments, ensuring a stress-free and time-efficient experience.

- Remote Transactions. DU Bill Payment ends the era of physical presence for bill payments. Its user-friendly interface allows users to quickly settle bills from the comfort of their homes or offices. This eradicates the need to travel, wait in long queues, or adhere to specific business hours, granting users the freedom to manage their payments conveniently.

- 24/7 Accessibility. The platform’s round-the-clock availability ensures that bill payments are no longer tied to traditional office hours. Users can access the service whenever it suits them best, whether it’s early morning, late at night, or during weekends. This flexibility caters to diverse schedules and ensures that time constraints do not constrain users.

- Swift Transactions. DU Bill Payment introduces swiftness into the payment process. Users can swiftly navigate through the platform with just a few clicks, select the desired service, input payment details, and finalize transactions. The streamlined process minimizes the time spent on each trade, freeing valuable time for other essential tasks.

- Mobile Accessibility. The convenience of DU Bill Payment extends to mobile devices, allowing users to manage their bills on the go. Through the DU mobile app, users can easily access and use the platform from their smartphones or tablets, making bill settlement possible no matter where they are.

- Centralized Platform. The platform acts as a centralized hub for various bill payments. Users can manage all these payments through a single interface, whether it’s settling mobile bills, home phone charges, or broadband subscriptions. This consolidation of services simplifies the user experience, reducing the need to navigate multiple platforms or websites for different bills.

- Reduced Administrative Burden. DU Bill Payment offers respite from the administrative burden of keeping track of numerous due dates and payment methods for businesses and individuals managing multiple bills. The platform’s automated features allow users to set up recurring payments and reminders, reducing the risk of missed fees and associated penalties.

Time-saving

DU Payment is your gateway to swift and seamless transactions. Streamlining the payment process empowers you to save precious time that can be channelled into more critical endeavours. No longer will you need to allocate significant chunks of your day to manage bills – DU Payment’s efficiency grants you the freedom to focus on what truly matters.

- Automated Payments. DU Bill Payment often allows users to set up automated recurring payments. This feature is particularly beneficial for bills that are due regularly, such as monthly mobile phone or utility bills. The platform handles the rest once users set up automatic payments, ensuring that accounts are settled on time without manual intervention. This saves time and minimizes the risk of late payment fees due to forgetfulness or oversight.

- Immediate Confirmation. Users typically receive immediate confirmation of their transaction after making a payment through DU Bill Payment. This eliminates waiting for postal or confirmation emails to verify the payment was successfully processed. This real-time confirmation reassures users that their prices are full, saving them the time and uncertainty of waiting for confirmation.

- Centralized Record Keeping. DU Bill Payment provides users a centralized platform to manage their payment history and records. Users can access their transaction history and details directly from the platform instead of searching through stacks of paper bills or emails for payment receipts. This centralized record-keeping saves time, enhances organization, and makes it easier to track past payments.

Improved Tracking & Management

Stay on top of your financial game with DU Payment’s advanced tracking and management features. The intuitive DU Payment interface comprehensively overviews your payment history and account balances.

By providing detailed transaction records, DU Payment facilitates improved financial organization, allowing you to manage your payments and services with clarity and precision.

- Comprehensive Transaction Records. DU Bill Payment keeps a detailed record of all your payment transactions. This includes information such as the date, time, amount, and the specific services or bills that were paid. These comprehensive records serve as a digital trail of your financial history, enabling you to easily review and verify past transactions.

- Real-time Account Balances. The platform offers real-time updates on your account balances after each transaction. This means you can instantly see the impact of your payments on your outstanding balances. This feature empowers you with up-to-the-minute information about your financial standing, helping you make informed decisions about future costs and expenses.

- Enhanced Financial Planning. With access to historical transaction data and current balances, DU Bill Payment becomes a valuable tool for financial planning. You can analyze your spending patterns, track trends in bill amounts, and identify areas where you can optimize your expenses. This data-driven approach to financial management can contribute to better budgeting and resource allocation.

- Convenient Payment Scheduling. DU Bill Payment often includes the option to schedule payments in advance. This feature is particularly beneficial for bills with fixed due dates. By planning costs, you can ensure that your accounts are settled promptly and avoid late fees. The ability to pre-plan payments contributes to better cash flow management.

- Automatic Reminders. Many bill payment platforms, including DU, offer automatic reminders for upcoming due dates. These reminders can be sent via email, SMS, or app notifications. You can avoid missing payments, stay organized, and maintain a positive credit history by receiving timely notifications.

- Centralized Management. DU Bill Payment is a centralized hub for managing bills and payments. Instead of juggling multiple websites, apps, or physical bills, you can conveniently access and manage various accounts from a single platform. This centralized approach streamlines your bill-paying process and reduces the risk of overlooking payments.

Conclusion

DU Bill Payment emerges as a trailblazing force in bill settlement in an age of digital transformation and user-centric solutions. With a comprehensive suite of features designed to enhance convenience and a robust security framework that safeguards user data, DU Bill Payment represents a paradigm shift in managing our telecommunications expenses.

By simplifying the bill payment process and providing users with a sense of security, DU empowers individuals to take control of their financial management in a digital era. Whether you are new to DU or a seasoned user, the benefits of DU Bill Payment are a testament to its commitment to enhancing the user experience.